How to Get Most Out of Catherines Credit Card

The Catherines Store Credit Card issued by Comenity Bank offers you some pretty decent rewards upwards of savings an extra 10% every day when you use your Perks card. Aside from that, their other bonus opportunities sounds kind of vague. Rewards can only be redeemed for store credit at Catherines, a View More >Frontier Airlines Credit Card Payment

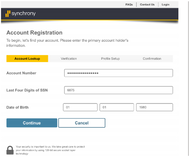

OnlineVisit the website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Read related terms and agreements.Check the information is accurate and submit your application. View More >CarCareONE Credit Card

Sign up for the CarCareOne Store Credit Card from Synchrony Bank and you will be able to reap No Interest on your auto maintenance and repair purchases if paid in full within 6 months on purchases of $199 or more. On top of that, you will be able to take advantage of special comprehensive tire financing, consolidate all of your repairs and maintenance expenses more easily, and your card will be accepted at over 25,000 gas stations and auto service centers nationwide including Exxon and Mobil, Chevron and Texaco. View More >Catherines Credit Card Payment

OnlineVisit Catherines Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remainin View More >How to Get Most Out of Raymour & Flanigan Credit Card

For people interested in a Raymour & Flanigan credit card, there are different financing offers available. Currently, the following is an overview of some of their financing offers:Preferred Financing: Standard APR applies, and if an account doesn’t have a previous balance, there’s no intere View More >How to Get Most Out of Value City Furniture Credit Card

On purchases of $999 or more with your Value Plus or Signature Plus credit card made between 11/12/2020 – 11/23/2020. 36 Equal Monthly Payments required. Not combinable with other storewide offers.Offer applies only to single-receipt qualifying purchases. No interest will be charged on promo purch View More >How to Get Most Out of Mor Furniture Credit Card

According to the Mor furniture website, the Mor Furniture for Less credit card has a number of different tiered financing options for consumers based on the amount of their purchase. Today’s special allows a minimum purchase of $899 (a few months ago, a purchase of $3999 was required to get the ma View More >How to Get Most Out of Sunoco Credit Card

The Annual Percentage Rate (APR) for this card is 23.0%, which may change according to the Prime Rate. The APR for cash advances is 24.99%. No balance transfers available. Transaction fees are either the greater of $5 or 5% for cash advances. Late payment and returned payments fees up to $35. The gr View More >Men’s Wearhouse Perfect Fit Credit Card >>

The Men’s Wearhouse Perfect Fit Credit Card is both a credit card and a rewards card for frequent shoppers, but customers don’t have to have the Perfect Fit Rewards credit card to be part of the program.With the Rewards Program, users get certificates that are valid for a period of six months after they’re issued. For every $500 in purchases a member makes, they get a $50 rewards credit. This can save a lot of money for customers who often shop in this store.

Men’s Wearhouse Perfect Fit Credit Card

The Men’s Wearhouse Perfect Fit Credit Card is both a credit card and a rewards card for frequent shoppers, but customers don’t have to have the Perfect Fit Rewards credit card to be part of the program.With the Rewards Program, users get certificates that are valid for a period of six months after they’re issued. For every $500 in purchases a member makes, they get a $50 rewards credit. This can save a lot of money for customers who often shop in this store.Men's Wearhouse Perfect Fit Credit Card Payment

OnlineVisit Men's Wearhouse Perfect Fit Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).How to Get Most Out of Men's Wearhouse Perfect Fit Credit Card

The primary benefit of the Perfect Fit Credit Card is that if you’re a frequent shopper at the store you earn a point for every dollar you spend. This includes Men’s Wearhouse, Men’s Wearhouse and Tux, and Men’s Wearhouse Outlet. Purchases include merchandise, alterations, tuxedo rentals, anLevin's Furniture Credit Card >>

Visiting top-performing stores and home furnishing retailers means you need to have your pocket be filled with cash. But with Levin Furniture Credit Card, you have a most preferred and hassle-free option to deal with payment problems. Levin Furniture Credit Card is offering 0% APR and also comes more additional advantages to best meet your requirements.

Levin's Furniture Credit Card Review

Levin Furniture Credit Card is very user-friendly. Many users have been praising the card and recommending it to their family and friends because of the great deals that it offers. However, this credit card is not a good option for contractors. If you want to leverage credit card benefits, you definHow to Get Most Out of Levin's Furniture Credit Card

This card is used as a credit card in a designated store. Although it does not currently provide any rewards, at least it can be used to purchase furniture in the store by credit card consumption. If you need to pay in cash, this card will be a good choice.Furniture can get quite expensive which isHow to Apply For Levin's Furniture Credit Card

OnlineVisit the Levin Furniture Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.Midas Credit Card >>

So, this Midas store card is another credit card from Synchrony Bank. But is this credit card really worth getting it? At a first sight, this credit card doesn’t seem to offer any tangible benefits. Yet, let’s discover the details of this credit card in our Midas credit card review. Midas Credit Card is a store credit card issued by Synchrony Bank. If you're wondering whether Midas Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.

Midas Credit Card Payment

Actually, you can make a payment on your Midas store card in three ways: online, by phone and by mail. Unfortunately, you are not able to make your payment in a store. Nonetheless, we will disclose how to make a payment in each of these ways right in this part of our credit card review.Of course, paThe Rewards of Midas Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers.If you often spend a lot of money on your car, this card can save you a lot of money.That can come in handy if you’re working on rebuilding your credit score. It’s also a good optMidas Credit Card

Midas Credit Card is a store credit card issued by Synchrony Bank. If you're wondering whether Midas Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.Kohl's Credit Card >>

The Kohl’s Credit Card, issued by Capital One, has “bargain shopper" written all over it. Fans of the department store can combine the card’s discount offers with rewards from Kohl’s other loyalty programs to maximize their savings throughout the year. And also, the Kohl’s Credit Card has relatively standard fees as store cards go, including a high APR.

The Rewards of Kohl's Credit Card

Rewards12+ special offers each year, 18+ special offers for Most Valued Customers (must spend $600+/year), birthday gifts and other surprises, receipt-free returnsThe Kohl’s Card offers an unimpressive 1:1 rewards on Kohl’s purchases, far below many of its retail card competitors and cash back cIs Kohls Credit Card Right for You?

Shopping from Kohl’s becomes easier when you have a Kohl’s Credit Card. Returns are smoother – no receipt required – as your purchase history can be accessed from the store’s database. Forget to bring your card? No problem! They’ll verify the information of your account, check the ID andKohl’s credit card.

Kohl’s credit card is a retail charge card, which means it can only be used for purchases of Kohl’s merchandise.BrandSource Credit Card >>

The BrandSource Credit Card is a Citi-provided credit card for financing purchases at BrandSource, a major retailer of appliances, electronics, and other home products with more than 4,500 locations nationwide. Cardholders also receive no-interest financing options and special offers and rebates.It requires a low credit rating and can be used at Brandsource stores.

Brand Source Credit Card

The BrandSource Credit Card is a Citi-provided credit card for financing purchases at BrandSource, a major retailer of appliances, electronics, and other home products with more than 4,500 locations nationwide. Cardholders also receive no-interest financing options and special offers and rebates.It requires a low credit rating and can be used at Brandsource stores.The Rewards of Brand Source Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers. If you are a loyal customer of BrandSource, then this card can provide you with new shopping methods and promptly notify you of special offers in the store.BrandSource Credit Card Payment

OnlineVisit BrandSource Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remainiRegions Bank Credit Card >>

Regions Bank is a brick-and-mortar bank with online banking and a mobile app that should satisfy most consumers. The bank provides branches and free ATMs in 15 states throughout the South and the Midwest.Regions Financial Corporation states that it has $129 billion in assets and provides full-service financial services at more than 1,500 branches and 2,000 ATMs.The holding corporation was chartered in 1970 with three banks: the First National Bank of Huntsville, the First National Bank of Montgomery, and the Exchange Security Bank of Birmingham.

How to Get the Most Out of Regions Premium Visa® Signature Credit Card

Have a personal checking account with Regions BankDeposit at least $15,000 in their checking account each monthHow to Apply For Regions Premium Visa® Signature Credit Card

If you have an existing Regions checking or savings account, you can simply complete an online application.If you are not a current Regions customer, or if you’d prefer to apply with the help of a Regions associate, you can visit your nearest Regions branch or call 1-800-REGIONS (1-800-734-4667).YRegions Premium Visa® Signature Credit Card Review

Full ReviewThe Regions Prestige Visa® Signature is a mid-level rewards card option from Regions Bank that features a base earning rate of 1X points on all purchases, a modest signup bonus, and no annual fee. It has a lower annual fee and earning rate than the Region Premium Visa® Signature (whichGreen Dot Credit Card >>

A good credit score can help you when you need to borrow money to pay down bills or buy a car. But you need a way to build credit. That’s what Green Dot primor and Platinum Secured Credit Cards work.These cards work just like any other credit card. The difference is that they collect a refundable security deposit from you in order to give you a line of credit. Your credit limit will be equal to the amount of your security deposit.Be sure to make on-time payments and keep your card balance low. Your payment and usage history gets reported to the three major credit bureaus, which can help you build a positive credit file over time.

Green Dot Visa® Secured Credit Card

The Green Dot Platinum Visa Credit Card has a reasonable APR for a secured credit card and doesn’t require a credit check. If you don’t want your credit score dinged with another credit inquiry, you should consider this option for rebuilding or establishing your credit.Review of Green Dot primor Visa Gold Secured Credit Card

Who Is This Credit Card Best For?The Green Dot primor Visa Gold Secured Credit Card is best for people who are looking to improve their credit score and don’t have the cash flow to pay off their balance in full each month. If you have a poor credit history (or none at all) and can’t avoid intereReview of Green Dot primor® Visa® Classic Secured Credit Card

Product Name Green Dot primor® Visa® Classic Secured Credit CardCard type VisaAnnual fee $39Purchase APR 13.99% fixed Balance transfer APR N/ACash advance rate 18.99% fixedCash advance fee $5 or 5% of the cash advance amount, whichever is greaterForeign transaction fee 3% of the transaction vVirgin Atlantic Credit Card >>

The Virgin Atlantic Card is issued by Bank of America, which has some application rules that are worth being aware of. It has one of the best returns on spending of any airline card, offers some perks just for having the card, and also has some spending bonuses that could even make it worthwhile to use this card for your purchases.

Virgin Atlantic Credit Card

The Virgin Atlantic Card is issued by Bank of America, which has some application rules that are worth being aware of. It has one of the best returns on spending of any airline card, offers some perks just for having the card, and also has some spending bonuses that could even make it worthwhile to use this card for your purchases.How to Apply For Virgin Atlantic Credit Card

OnlineVisit the Virgin Atlantic Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Read related terms and agreementsCheck the information is accurate and submit yourVirgin Atlantic Credit Card Payment

OnlineVisit Virgin Atlantic Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remEdward Jones Credit Card >>

Edward Jones Credit Card is issued by Elan Financial Services and they reward their customers with lots of offer like; loyalty points and reward which gives the cardholder joy to use at any point in time. Edward Jones credit card is mainly for their Customers and it offers a no annual fee rate. Outlined below are the benefit accrued to Edward Jones credit card clients.

Edward Jones Credit Card Review

Full ReviewTwo options. There are actually a few different Edward Jones Credit Cards, and not all of them have their own applications. More specifically, you can apply for the Edward Jones World Plus Mastercard and the Edward Jones World Mastercard independently of one another. But if you don'tHow to Apply For Edward Jones Credit Card

OnlineTo apply for Card , Visit the Edward Jones Credit Card Official Webpage at www.edwardjones.comHow to Get the Most Out of Edward Jones Credit Card

Redeem for rich rewards from Edward Jones Loyalty Invest™Spent on prepaid car and hotel reservations made in the online Rewards Travel CenterEl Dorado Furniture Credit Card >>

Dorado Furniture is one of Southern Florida’s largest family owned and operated furniture stores. They first opened in 1967. Since then, they have grown to twelve “Boulevard “showrooms, which are modeled as a Main Street surrounded by shops that showcase their different lines of furniture. They also offer their El Dorado Furniture BLUCard, which is a great way to pick the living room set of your dreams without having to pay for it in one lump sum.

The Rewards of El Dorado Furniture Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers. If you are a loyal customer of El Dorado Furniture, then this card can provide you with new shopping methods and promptly notify you of special offers in the store.You get exclusiveHow to Get Most Out of El Dorado Furniture Credit Card

Using a furniture credit card, which is often easier to get with less than stellar credit, is an easy way to improve your credit score. You can rebuild your credit if you make payments on time and pay off the balance in full before the end of the interest free period. Also keeping your balance on thEl Dorado Furniture Credit Card Payment

OnlineVisit El Dorado Furniture Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete theNeiman Marcus Store Card >>

Neiman Marcus sells some of the world’s best clothing, shoes, handbags and accessory brands. As a specialty department store it’s no wonder it has so many loyal customers. With their InCircle Points rewards program, you get great deals on most items in their store, online at NeimanMarcus.com, or with their partners. Use this guide to take advantage of all the perks that being a Neiman Marcus customer offers.

How to Apply For Neiman Marcus Store Card

OnlineVisit the Neiman Marcus Store Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Read related terms and agreements.Check the information is accurate and submit your apNeiman Marcus Store Card Payment

OnlineVisit Neiman Marcus Store Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remainNeiman Marcus Store Card

Neiman Marcus sells some of the world’s best clothing, shoes, handbags and accessory brands. As a specialty department store it’s no wonder it has so many loyal customers. With their InCircle Points rewards program, you get great deals on most items in their store, online at NeimanMarcus.com, or with their partners. Use this guide to take advantage of all the perks that being a Neiman Marcus customer offers.Shell Co-Branded Credit Card >>

Shell credit cards offer rewards for your purchases at Shell and provide a more secure way to do your shopping. Filling up has never been so rewarding! Shell is the number one global lubricant supplier, delivering market-leading lubricants to consumers in over 100 countries. Shell Lubricants brings world-class technological insights to its products, offering you the best formulations for your vehicle.

Shell Fuel Rewards Card Payment

The best way to make a Shell Credit Card payment is online, where you can make a one-time payment or set up a monthly automatic payment.You can also call 1-866-743-5562 to pay your Shell Credit Card bill by phone, or you can send your payment by regular mail. The mailing address is: Shell Card PaymeShell Fuel Rewards Card

If you’re a regular at Shell stations and don’t have the best credit, the Shell Fuel Rewards Card may be a good way to save some money each time you’re at the pump with immediate savings—no waiting for rebates.Who Is Shell Fuel Rewards Card Best For?

If you’re a regular Shell customer with imperfect credit, the Shell Fuel Rewards Card may be a good choice for saving a couple of bucks every time you gas up. You’ll get an instant discount of 10-cent per-gallon at the pump as long as you maintain Gold-level Fuel Rewards membership status. Plus,Delta Skymiles Credit Cards >>

SkyMiles is the frequent-flyer program of Delta Air Lines that offers points to passengers traveling on most fare types, as well as to consumers who utilize Delta co-branded credit cards, which accumulate towards free awards such as airline tickets, business and first-class upgrades, and luxury products. Created in 1981 as the "Delta Air Lines Frequent Flyer Program"; its name was changed to SkyMiles in 1995.

Delta SkyMiles® Gold American Express Card Review

Full ReviewA great choice for Delta loyalists, especially the first year, Delta SkyMiles® Gold American Express Card offers a great initial bonus, waives its hefty annual fee year one, and gives you at least one free checked bag every time you fly – just to name a few of its perks. But things areHow to Apply For Delta SkyMiles® Gold American Express Card

The easiest way to apply for the Gold Delta Skymiles card is online.If you have a mail offer, fill out the application form you received and mail it back in the addressed, postage-paid envelope that came with the offer. Alternatively, you can visit the Amex credit card website and click on "ResThe Rewards of Delta SkyMiles® Gold American Express Card

RewardsEarn 50,000 bonus miles after you spend $2,000 in purchases on your new Card in your first 3 months, Offer Expires 10/28/2020.Earn 2X Miles on Delta purchases, at restaurants worldwide, including takeout and delivery and at U.S. supermarkets.NEW! Earn now. Travel when you're ready. AfterTorrid Credit Card >>

A popular plus-size apparel company, Torrid started as a subset of Hot Topic, a retailer specializing in "counterculture" apparel and accessories. While Torrid originally mimicked Hot Topic's alternative styles, it later branched out from the edgier retailer, becoming its own LLC in 2015. The new Torrid offers a wide range of more mainstream clothing styles for women and girls in sizes 10 to 30, with over 400 stores across the US.

Torrid Credit Card Review

Full ReviewNice initial discount. You will receive 25% off your first online purchase with the Torrid Credit Card, which could save you a bundle if you time things right. This isn't the biggest first-purchase discount available from a store card but it's still a great deal if you're planTorrid Credit Card

Like many popular retailers, Torrid offers a closed-loop consumer credit card for those who want to save a little on their branded purchases. Unlike most other store credit cards, however, the Torrid Insider Credit Card is a little light on the rewards, good only for the occasional coupon or special offer. And while the card doesn't have an annual fee, the high APR makes it a questionable addition to your wallet.Victoria's Secret Angel Credit Card >>

Victoria's Secret Angel Credit Card is a credit card provided by Victoria's Secret for customers to help shopping. Victoria's Secret, founded in 1977, mainly deals in women's underwear, underwear, pajamas, swimsuits, shoes, perfume and beauty products. This brand offers customers a kind of credit card. Victoria's Secret Angel Credit Card is more suitable for Victoria's Secret Angel loyal shoppers, providing customers with a good shopping experience, bringing more shopping discounts. So if you like shopping, you can learn some ways to save money.

Victoria's Secret Credit Card Payment

OnlineIf you pay online before 8 p.m. EST, you’ll be credited for paying on that same day; after 8 p.m. EST, you’ll be credited for paying the next day. The transaction may take up to two business days to complete, but you’ll be credited for paying according to the rules just described.This meThe Rewards of Victoria's Secret Credit Card

RewardsAt the first two membership tiers — Angel and Angel VIP — the Victoria’s Secret Angel Card provides a 12% cash back equivalent for bra purchases at Victoria’s Secret, with a 4% cash back equivalent for other purchases. Points are worth 4 cents each at these tiers.At the highest memberVictoria's Secret Credit Card

The Victoria’s Secret Angel Card provides some strong benefits and high rewards for Victoria’s Secret shoppers who spend a significant amount of money on their lingerie. Just watch out for its high APR; you won’t want to carry a balance on the card, or it may become more of a curse than a blessing.Peebles Credit Card >>

The credit card from Peebles offers the most generous reward rate on the market, which reaches 10%. However, the rewards quickly expire, and you unlikely to benefit from this credit card if you shop at Peebles rarely. So, while this credit card is a good solution for active Peebles shoppers, you shouldn’t get this card if you are not one of them.

Peebles Credit Card

The credit card from Peebles offers the most generous reward rate on the market, which reaches 10%. However, the rewards quickly expire, and you unlikely to benefit from this credit card if you shop at Peebles rarely. So, while this credit card is a good solution for active Peebles shoppers, you shouldn’t get this card if you are not one of them.How to Apply For Peebles Credit Card

At first, you must open your browser and go to the official website. Then, you will get to see the webpage of Comenity Bank and Peebles, dedicated to this credit card. At that point, you have to click on the "Apply Now" button, which you can spot in the center of the page.How to Get the Most Out of Peebles Credit Card

Enjoy Christmas Reward and discount every Tuesday.Receive a Birthday GiftEarn points by using cardBMO Credit Card >>

Founded in 1882, BMO Harris is the 8th largest bank in North America based on assets. There are now more than 500 branches in eight states and the bank serves individuals, families, and businesses. This in-depth review of BMO Harris Bank helps you learn more and decide if the bank is right for you.

BMO Harris Bank Premium Rewards Mastercard Payment

OnlineIf you're paying your BMO credit card, it's faster to do so by using the Make a Transfer option. To pay BMO credit cards sign in to BMO Online Banking and:Click Payments & Transfers.Click Make a Transfer.Select the account you wish to debit.Select the BMO credit card you wish to paBMO Harris Bank Premium Rewards Mastercard

For $79 a year, the BMO Harris Bank Premium Rewards Mastercard offers solid rewards for frequent travelers, but the card’s moderately high APR and short interest-free balance transfer period limit its appeal as a balance transfer card.How to Apply For BMO Harris Bank Premium Rewards Mastercard

OnlineSearch for the official websiteFollow the requirement and entry the needed messages.Gardner-White Credit Card >>

Gardner-White Furniture is an American furniture retailer founded in 1912, based in Auburn Hills, Michigan. They’ve been setting the standard in quality, value, and service since then striving to provide the best furniture, with great style for less than you’d expect to pay. Right now, you can get the Gardner-White Furniture Store Credit Card from Comenity Bank and get in on exclusive sales events, better financing options, and dedicated customer service, all at no annual fee attached. If you’re looking to re-up on furniture, there are some things you should consider with this card.

Gardner-White Credit Card

Gardner-White Furniture is an American furniture retailer founded in 1912, based in Auburn Hills, Michigan. They’ve been setting the standard in quality, value, and service since then striving to provide the best furniture, with great style for less than you’d expect to pay. Right now, you can get the Gardner-White Furniture Store Credit Card from Comenity Bank and get in on exclusive sales events, better financing options, and dedicated customer service, all at no annual fee attached. If you’re looking to re-up on furniture, there are some things you should consider with this card.How to Get Most Out of Gardner-White Credit Card

You can make Gardner White credit card payment at any Gardner White furniture store. also, you can the credit card for online or store purchase.Gardner white credit card financing can be carried out online if you have registered for an online access. Alternatively, you can fund your credit card fromThe Rewards of Gardner-White Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers. If you are a loyal customer of Gardner-White, then this card can provide you with new shopping methods and promptly notify you of special offers in the store.In addition, as a storeCo-Branded Hotel Cards >>

If a road warrior loyal to a particular hotel chain, a co-branded hotel credit card can be a no-brainer. Unlike airline credit cards that often don’t offer strong enough perks to justify paying an ongoing annual fee, most hotel cards offer extremely valuable benefit packages with perks like anniversary free night certificates, complimentary elite status, bonus points and potentially even on-property credits. Now, let’s take a look at the following best co-branded hotel credit cards.

IHG® Rewards Club Traveler Credit Card

The IHG Rewards Club Traveler Credit Card is worth considering if you regularly stay at InterContinental, Holiday Inn, Crowne Plaza or one of the other popular hotel brands owned by IHG but do not want to pay an annual fee in order to earn extra rewards points with an IHG credit card. In addition to a $0 annual fee, the IHG Traveler Card offers an initial bonus of 100,000 points to new cardholders who spend at least $2,000 within 3 months of opening an account. It also rewards users with 1 - 5 points per $1 normally.Hilton Honors Aspire Card

Designed for the frequent traveler and Hilton enthusiast, the Hilton Honors Aspire Card offers a plethora of strong perks and benefits if you’re willing to shell out for the $450 annual fee. You’ll earn tons of Hilton points thanks to your card and automatic Diamond status, and get perks like a free night every year, airport lounge access, and a number of annual Hilton and airline credits.Bank of America® Travel Rewards

A simple points structure, no annual fee, an intro APR offer, and a hefty signup bonus make the Bank of America® Travel Rewards credit card our top pick for travel rewards. You’ll get 1.5 points for each dollar spent and an additional 1.5 points — a total of 3 points — on noninsurance purchases made through the Bank of America Travel Center.Valero Credit Card >>

If you regularly fill your car’s fuel tank with 50 to 75 gallons or more of gas each month and can’t qualify for an everyday rewards card that lets you earn more gas rewards, the Valero credit card could be a decent alternative. This private label “credit builder” card offers a large enough rebate on gas purchases to significantly trim your annual expenses—especially if you drive a gas guzzler or spend a lot of time on the road.

How to Get the Most Out of Valero Credit Card

Valero calculates the amount you earn based on the number of gallons you purchase, rather than the amount of money you spend. So, to get the maximum possible value out of your card, continue to seek out the cheapest gas you can find from Valero-affiliated stations. A gas app, such as GasBuddy, can hValero Credit Card

If you regularly fill your car’s fuel tank with 50 to 75 gallons or more of gas each month and can’t qualify for an everyday rewards card that lets you earn more gas rewards, the Valero credit card could be a decent alternative. This private label “credit builder” card offers a large enough rebate on gas purchases to significantly trim your annual expenses—especially if you drive a gas guzzler or spend a lot of time on the road.Valero Credit Card Review

Details of ProsA modest rebate for everyday drivers: You won’t be buying any big vacations or funding shopping sprees with the rewards you get from this card. But if you typically buy between 50 and 74.99 gallons worth of gas each month, you could earn up to $36 back per year. That’s more than yFirst National Bank Credit Card >>

The First National Bank Secured Visa Card is a secured credit card. People with bad credit can use this card to establish or rebuild credit. You can request your own credit limit with a security deposit between $300 and $5,000. This deposit may be returned automatically in as little as 11 months when you make your payments on time. Regular, on-time payments can also help you qualify for a credit limit increase without an additional deposit in as little as seven months. Cardholder benefits include a free FICO credit score each month, fraud protection and zero liability coverage.

First National Bank of Omaha Secured Visa® Card Payment

OnlineWhen you enroll or log in to your account online you can make payments from any device that are secure, timely and free. Easily schedule one time payments or recurring monthly payments to your account. Remember you must pay at least the minimum payment due that is located on your monthly stateHow to Apply For First National Bank of Omaha Secured Visa® Card

OnlineVisit First National Bank’s site and find the Secured Visa® Card in the Credit Cards tab. Click Apply Now.Complete the application with your personal contact, ID, housing and financial information. Add any authorized users, and then supply your deposit information, including your bank accouHow to Get the Most Out of First National Bank of Omaha Secured Visa® Card

With no monthly and annual fees, it’s easy to get the most out of this card. Start by setting up a credit limit that works for your budget — anywhere from the $300 minimum to a high $5,000 in $50 increments. Reasonable APRs and low fees make it easy to stay on top of your payments.It also rewardBergner's Credit Card >>

Bergner’s is a retail store owned and operated by the bon ton brand. With locations across the mid-Atlantic, central and northern America, they offer a range of Department store products including homeware and beauty and fragrances at competitive prices.If you are looking for in store card that gives you a flexible reward scheme based on points then the Bergner’s credit card may be just what you are looking for.

Bergner's Credit Card Review

Full ReviewThere are two membership levels with this credit card – signature and elite. You automatically get signature status when you open the credit account, and once you spend over $1500 you are awarded with Elite status. Unlike other credit cards there are no annual limits in which you accrueThe Rewards of Bergner's Credit Card

Earn 1 point for every $1 spent with the cardReceive a Birthday celebration offer, Exclusive Savings Offers and Special Email Promotions.Reach Elite status after spending $500 - $1,499 in a calendar year and VIP status after spending $1,500 in a calendar yearSpend $200 and earn a $20 Rewards Card. UHow to Get Most Out of Bergner's Credit Card

Bergner’s credit card’s primary rewards scheme gives you one point every dollar you spend, either in-store or online. Spend $500 (equivalent to 500 points) and Bergner’s will give you all day savings card. This savings card can be used from the day you receive it until 60 days’ time, giABC Warehouse Credit Card >>

ABC Warehouse is a chain of retail stores, specializing in appliances and electronics in the USA. They offer the credit card facility to their customers, issued by Synchrony Bank. Electronics and home furnishing store ABC Warehouse has partnered with Synchrony Bank to offer credit card to its customers. The credit card not only comes with special financing option, but it also offers the cardholders a complete online solution. Cardholders can pay their shopping bills and get details of the transactions online.

ABC Warehouse Credit Card

ABC Warehouse is a chain of retail stores, specializing in appliances and electronics in the USA. They offer the credit card facility to their customers, issued by Synchrony Bank. Electronics and home furnishing store ABC Warehouse has partnered with Synchrony Bank to offer credit card to its customers. The credit card not only comes with special financing option, but it also offers the cardholders a complete online solution. Cardholders can pay their shopping bills and get details of the transactions online.The Rewards of ABC Warehouse Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers. If you are a loyal customer of ABC Warehouse, then this card can provide you with new shopping methods and promptly notify you of special offers in the store.That can come in handy iABC Warehouse Credit Card Review

Full ReviewABC Warehouse is a chain of retail stores, specializing in appliances and electronics in the USA. They offer the credit card facility to their customers, issued by Synchrony Bank. Electronics and home furnishing store ABC Warehouse has partnered with Synchrony Bank to offer credit card toAventium Credit Card >>

You have possibly heard of some unscrupulous financing options available strictly for consumers with credit ratings that are poor. Nevertheless, most consumer believe that the Aventium credit card has tremendously plummeted to an all-time low. If you have a damaged credit, then you most likely want it repaired. You’ve perhaps rummaged far and wide only to be confronted with this kind of financing option as the ultimate choice for consumers with credit ratings that are below average.

How to Apply For Aventium® Classic Credit Card

OnlineVisit the Aventium® Classic Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.Aventium® Classic Credit Card

You have possibly heard of some unscrupulous financing options available strictly for consumers with credit ratings that are poor. Nevertheless, most consumer believe that the Aventium credit card has tremendously plummeted to an all-time low. If you have a damaged credit, then you most likely want it repaired. You’ve perhaps rummaged far and wide only to be confronted with this kind of financing option as the ultimate choice for consumers with credit ratings that are below average.Aventium® Classic Credit Card Payment

OnlineVisit Aventium Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remaining paymeKroger Credit Card >>

The Kroger Company, or simply Kroger, is an American retail company founded by Bernard Kroger in 1883 in Cincinnati, Ohio. It is the United States' largest supermarket by revenue ($121.16 billion for fiscal year 2019), and the second-largest general retailer (behind Walmart). Kroger is also the fifth-largest retailer in the world and the fourth largest American-owned private employer in the United States. Kroger is ranked #20 on the Fortune 500 rankings of the largest United States corporations by total revenue.

Who Is Kroger REWARDS World Mastercard Best For?

The value of the rewards is so unimpressive that it’s pretty hard to recommend this card, but if you’re a fan of Kroger stores (or Dillons, Ralphs, or the other stores owned by Kroger Co.)1 and have good credit, the Kroger REWARDS World Mastercard may be able to save you quite a bit on gasKroger REWARDS World Mastercard Review

Details of ProsGas discount for first year: You’ll get 25 cents off per gallon for the first year you have an account, as long as you redeem at least 100 fuel points earned through Kroger’s loyal shopper program whenever you use your card at the pump. It shouldn’t be hard for regular customersKroger REWARDS World Mastercard

The Kroger REWARDS World Mastercard rewards loyal Kroger shoppers with points on their purchases, but the points are worth so little, you’re better off with a number of competing cards that pay more and let you use your earnings anywhere. Perhaps the one reason to get the card: the potential for a sizeable discount on gas purchases at Kroger stations during your first year.Surge Mastercard Credit Card >>

The Surge Mastercard® is one of the easiest credit cards to get if you have bad credit, but the card's annual and monthly fees may reduce its appeal. If you're considering the Surge Mastercard® to build credit, here's what you need to know before you submit your application.

Surge Mastercard® Credit Card Payment

You can submit a Surge credit card payment from your account online. Or, you can pay your Surge credit card bill by phone, at 1-800-518-6142. Phone payments can be made from 7 am to 10 pm ET Mon–Fri, and 8 am to 4 pm on Saturday.Surge card payments can also be sent by mail. Mail a check, along witSurge Mastercard® Credit Card

The Surge Mastercard® is one of the easiest credit cards to get if you have bad credit, but the card's annual and monthly fees may reduce its appeal. If you're considering the Surge Mastercard® to build credit, here's what you need to know before you submit your application.Surge Mastercard® Credit Card Review

Full ReviewThe Surge Mastercard® Credit Card is a legit credit card for people with bad credit, not a scam. It reports to the three major credit bureaus each month, which allows cardholders to build credit by paying on time and using only a portion of their credit limit. The problem is the Surge CrComerica Credit Card >>

Comerica Bank Visa Platinum® Card is a credit card issued by Comerica Bank. If you're wondering whether Comerica Bank Visa Platinum® Card is the right card for you, read on. This is everything you need to know to make a good choice. The Comerica Visa® Real Rewards won’t change the game when it comes to rewards, but it still offers everyday value for Comerica Bank customers who want decent rewards, an introductory bonus, and no annual fee.

How to Get the Most Out of Comerica Visa® Real Rewards Card

Earn decent rewards while enjoying a modest introductory bonusHave a small balance to pay downPlan a substantial purchase they wish to pay off over several monthsHow to Apply For Comerica Visa® Real Rewards Card

OnlineSearch for the official websiteFollow the requirement and entry the needed messages.Comerica Visa® Real Rewards Card Review

Full ReviewThe Comerica Visa® Real Rewards Card is a basic-yet-effective rewards card that will serve Comerica banking customers well with everyday use. The card charges no annual fee and earns a respectable flat rate of points with every purchase.How to Earn PointsThe Comerica Visa® Real RewardsFifth Third Bank Credit Card >>

Fifth Third Bank is a major U.S. bank that serves 10 states in the Midwest and Southeast. It currently has branches and ATMs in Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Ohio, Tennessee, and West Virginia. The bank offers checking and savings accounts, certificates of deposit, credit cards, loan products, insurance, and investing services.

TRIO® Credit Card from Fifth Third Bank

The TRIO® Credit Card from Fifth Third Bank is great if you don’t spend too much on your card, but still want to earn cash back when you buy groceries and gas, or when you dine out.The card offers good basic perks, though it doesn’t have some of the benefits cards for higher credit scores deliver.How to Apply For TRIO® Credit Card from Fifth Third Bank

OnlineGo to the Fifth Third Bank website and find the TRIO® Credit Card. Click Apply now.Fill out the form with your personal details.Review and submit your completed application.TRIO® Credit Card from Fifth Third Bank Review

Full ReviewThe TRIO Credit Card from Fifth Third is a fine choice for people with 700+ credit scores who spend around $500 per month at restaurants, gas stations, grocery stores and drug stores. The TRIO Card requires good credit or better for approval, you see, and we recommend setting your sightsLowe's Credit Card >>

Lowe's Credit Card is a credit card provided by Lowe's for customers to help shopping. Founded in 1946, Lowe's is the 15th largest retailer in the United States, headquartered in North Carolina, specializing in home decoration. Lowe's offers customers four types of credit cards. Lowe's Credit Card is more suitable for Old Lowe's loyal shoppers, providing customers with a good shopping experience, bringing more shopping discounts. So if you like shopping, you can take a look at the following to learn some ways to save money.

Lowe’s Advantage Card

If you're a Lowe's loyalist, the Lowe's Advantage Card can make a lot of sense. Unlike store cards that give you rewards points that have value only if you return to the store and spend more money, this $0-annual-fee card gives you a flat 5% discount on almost everything at Lowe's. The card also offers deferred-interest financing for larger purchases — but if you take advantage of it, you need to be careful, or you could be in for a nasty surprise.Lowe’s Advantage Card Payment

OnlineYou can pay your Lowe's Credit Card online either by signing in to your account or paying as a guest. You can even set up AutoPay to have your bill paid automatically each month.By the PhoneAlternatively, you can pay by calling 1-888-840-7651 or in Lowe's store at the customer serviceHow to Get the Most Out of Lowe’s Advantage Card

HowCheck the store's list of inventory and consider shifting some of your everyday purchases to Lowe's. In addition to building supplies and appliances, Lowe's sells a surprising variety of home-related items: plants, home decor, furniture, cleaning supplies, pet care items, sports equipSpirit Airlines Credit Card >>

Spirit Airlines credit card doesn't offer a cash signup bonus. However, it does include a 30000 points signup bonus after spending $500 that can be redeemed for travel, gifts, or other perks.You’ll earn 15,000 bonus miles after making just a single purchase with the Spirit Airlines Credit Card. This is a good reward for customers who often need to travel by plane.

Spirit Airlines Credit Card Review

Full ReviewSmall rewards bonus. You’ll earn 15,000 bonus miles after making just a single purchase with the Spirit Airlines Credit Card. And while Spirit says you can squeeze three roundtrip flights from that sum, as long as you travel outside of peak season for your destination, Spirit miles arenSpirit Airlines Credit Card

Spirit Airlines credit card doesn't offer a cash signup bonus. However, it does include a 30000 points signup bonus after spending $500 that can be redeemed for travel, gifts, or other perks.You’ll earn 15,000 bonus miles after making just a single purchase with the Spirit Airlines Credit Card. This is a good reward for customers who often need to travel by plane.The Rewards of Spirit Airlines Credit Card

RewardsEarn 15,000 Free Spirit™ bonus miles after your first purchase.Earn an additional 15,000 bonus miles after making at least $500 in purchases within 90 days of account opening.Earn 2 miles for every dollar you spend on purchases.Collect 5,000 anniversary bonus Free Spirit™ miles when you sMilestone Mastercard >>

The Milestone Gold Mastercard from The Bank of Missouri is an unsecured credit card designed to help you build or rebuild your credit history. Depending on your credit situation and how you use the card, however, it could get expensive.Requiring no security deposit, the Milestone Gold Mastercard is among a few cards that allow those with bad credit or no credit at all to get credit without having to put down money. Its minimum credit limit is $300 and its annual fee can be as high as $99.

How to Apply For Milestone Gold Mastercard

OnlineTo apply now for the Milestone Gold card, head over to the official website. You can securely input all of the required information in order to check your prequalification status before applying for the card!By prequalifying first, you can check whether or not you are likely to be approved forHow to Get Most Out of Milestone Mastercard

Like the Milestone Gold Mastercard, the Credit One Bank Unsecured Visa®for Rebuilding Credit uses a pre-qualification process to determine the annual fee, APR and the details of the rewards program. The potential APRs are lower than the Milestone Gold Mastercard, and the annual fee varies between $The Rewards of Milestone Gold Mastercard

Although this card does not currently provide any rewards, the credit requirements of this card are very low, and the low annual fee can help customers quickly re-establish credit.In addition, this card will increase the basic limit based on your credit, and occasionally launch some interest-free acSams Credit Card >>

The Sam’s Club Credit Card, issued by Synchrony Bank, is a basic store credit card for Sam’s Club members with a less-than-stellar credit profile. The Sam’s Club Credit Card can only be used at Sam’s Club and Walmart stores and doesn’t offer any rewards on purchases, so it’s mainly for borrowers who aren’t likely to qualify for a better credit card that can be used more broadly. If your credit is just fair (if you have a FICO score of 580 to 669) and you shop at Sam’s Club and Walmart frequently, this card can be a worthwhile financing tool, albeit with a steep interest rate.

How to apply for Sam's Club® Credit Card

Before you apply for the card, you need to have a SamsClub.com membership. Once you do:Locate the Sam's Club® Credit Card on the website.Click Apply now.Sign in to your account or register for an account with your membership number and zip code.Fill out the application form.Review the form andShould You Get The Sam’s Club Mastercard?

The Sam’s Club Mastercard offers very high rewards and is a fantastic value – provided you don’t mind its inconvenient redemption method. Rewards accumulated through the card may only be redeemed once per year, at a Sam’s Club store. This can be problematic, especially for individuals who coOptions to pay Sam's Club Credit

Paying your Sam's Club credit bill online is fast and simple:Visit www.samsclub.com/credit Select Manage Your Credit Account near the topIf you are unsure which card type you have, please reference your physical card and select a login that matches your cardYou can also:• Request a creditCitibank Credit Card >>

Citi—also known as Citibank—was born more than two centuries ago in 1812 as City Bank of New York. It's the fourth-largest commercial bank in the United States with $1.45 trillion in assets, more than 60,000 ATMs, and locations throughout the U.S., many located in California, New York, and Texas. Our in-depth review will help you determine whether banking with Citi is right for you.

Citi Prestige Credit Card Review

Full ReviewAnnual Bonuses. The Prestige Card gives you a $250 annual travel credit as well as a credit of up to $100 every five years for the cost of TSA Precheck or Global Entry.Airport and hotel perks. Citi Prestige cardholders receive complimentary access to more than 1,300 Priority Pass Select aHow to Get the Most Out of Citi Prestige Credit Card

Use your Citi Prestige Credit Card to spend $4,000 within three months to earn 50,000 points right away—you will have covered the cost of the annual fee. Make sure you use this card for airfare, hotels, cruises, and restaurants specifically—not only to earn bonus points, but to get the $250 annuCiti Prestige Credit Card

The Citi Prestige Credit Card is a premium travel rewards card that pays premium rewards, a big sign-up bonus, and outstanding, luxury travel perks. The tradeoff? There’s a $495 annual fee.Nordstrom Credit Card >>

Having opened its first store in 1901, Nordstrom has since spent the better part of a century reigning as a leader among luxury department stores. The modern Nordstrom empire includes its flagship full-line stores and compact Nordstrom Rack stores, as well as Trunk Club and Jeffrey boutiques locations, totaling 349 stores operating in 40 states, Canada, and Puerto Rico.

Nordstrom Credit Card Review

Full ReviewLike most major retailers, Nordstrom offers two credit cards: one that can be used to make only Nordstrom purchases and another that works pretty much anywhere plastic is accepted. However, you cannot simply choose the version you want and apply for it directly. All applicants are first cHow to Apply For Nordstrom Credit Card

OnlineYou will need your Social Security number and a form of ID such as a driver's license, state ID, passport, green cards or military ID.Visit the Nordstrom credit application site and click "Apply Now."Fill out the Nordstrom credit card application with the details of your currentNordstrom Credit Card Payment

By MailNordstrom credit cardholders receive a paper statement at the end of their billing cycle each month. Fill out the tear-off section and return it with a payment check in the provided, pre-addressed envelope. For lost statements, write a payment check, include your account number in the memo arPalais Royal Credit Card >>

Palais Royal Credit Card is issued by Comenity Bank. It offers users numerous perks and benefits which makes their transactions at Palais Royal Stores more rewarding.It has no annual fee charge attached to it, no introductory APR rate required. On the whole, it is a card with low credit requirements. Palais Card can be used at Palais Royal Stores.

The Rewards of Palais Royal Credit Card

RewardsReceive a Welcome Coupon worth $5 off. Plus, receive a Shopping Pass upon approval for 15% off all merchandise on your first day's purchases.Earn 2 points for every $1 spent with your Palais Royal Credit Card. Earn a $5 reward for every 100 points earned.Birthday Gift - $10 for PreferredHow to Get The Most Out of Palais Royal Credit Card

Use it to spend on the day when you get this cardYou will receive a Welcome Coupon worth $5 off. Plus, receive a Shopping Pass upon approval for 15% off all merchandise on your first day's purchases.Use it to consume in Palais Royal Stores Discounts and Rewards comes on almost anythingPalais Royal Credit Card Review

Full ReviewThe Palais Royal credit card makes shopping at the stores very rewarding since it offers some perks and rewards that make having the card worthwhile.An Online Account allows users can make bill payments and manage their accounts online. Palais Royal credit card is offered by the ComenityLord and Taylor Credit Card >>

Consumers who love Lord & Taylor’s rich selection of stylish fashions may find the Lord & Taylor Credit Card useful for saving more on their frequent sprees. The credit card can make a difference at checkout if you’re a regular customer thanks to its rewards program that dishes out 5% cash back on purchases, plus cardholder access to special perks through a membership upgrade when you spend $1,000 in a calendar year.

Lord and Taylor Credit Card

Consumers who love Lord & Taylor’s rich selection of stylish fashions may find the Lord & Taylor Credit Card useful for saving more on their frequent sprees. The credit card can make a difference at checkout if you’re a regular customer thanks to its rewards program that dishes out 5% cash back on purchases, plus cardholder access to special perks through a membership upgrade when you spend $1,000 in a calendar year.How to Get the Most Out of Lord and Taylor Credit Card

RewardsSpent in net qualifying purchases with your cardEnjoy exclusive member-only eventsGet Premier Rewards benefits like Free Shipping Codes (sent via email) and Couponless Shopping for that calendar yearHow to Apply For Lord and Taylor Credit Card

OnlineVisit the Lord & Taylor Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.Bealls Florida Credit Card >>

While today comprised of Bealls Florida and Bealls Outlet, the Bealls, Inc. company began in 1915 as a dry goods store in Bradenton, Florida. Dedicated to affordability, Robert Beall's original store was called The Dollar Limit and sold all of its merchandise for $1 or less. Today's Bealls department stores maintain the original spirit of thrift by offering discount and budget fashion to customers from its 500 nationwide locations.

Bealls Florida Credit Card

Similar to other multi-faceted brands, Bealls has two distinct credit card products for each of its main brands. The Bealls Florida Credit Card, which earns Coast2Coast Rewards, is usable at Bealls Florida locations. The Bealls Outlet Credit Card, which operates on the One Card loyalty program, can be used in Bealls Outlets nationwide.How to Get the Most Out of Bealls Florida Credit Card

Frequently shop at any of 500 Bealls department stores.How to Apply For Bealls Florida Credit Card

OnlineVisit the Bealls Florida Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.If you're denied clickRoaman's Credit Card >>

Roaman’s is a store chain committed to finding plus-size women the very best in fashion while not compromising on quality. They have everything from bras to outerwear to simple everyday business attire. Getting a Roaman’s credit card is the first step in finding fashion that fits, and being able to shop when you need to without worrying about money.

Roaman's Credit Card

Roaman’s is a store chain committed to finding plus-size women the very best in fashion while not compromising on quality. They have everything from bras to outerwear to simple everyday business attire. Getting a Roaman’s credit card is the first step in finding fashion that fits, and being able to shop when you need to without worrying about money.Roaman's Credit Card Review

No annual fee.One of the most important features of a store card is the no annual fee. The reason for this is because as store card interest rates tend to be a bit higher than standard bank cards, every dollar you pay for an annual fee bumps up the APR a little. The result is you find your credit liHow to Get Most Out of Roaman's Credit Card

Adding another year is a positive thing in the world of Roaman’s. To help you celebrate your birthday, they give you a 20% discount on virtually anything in the store every year you are a card member and your account is in good standing.Roaman’s extend the birthday celebration to the entire montToys R Us Credit Card >>

Toys "R" Us is an international toy, clothing, and baby product retailer owned by Tru Kids, Inc. (d.b.a. Tru Kids Brands) and various others. It was founded in April 1948, with its headquarters located in Wayne, New Jersey, in the New York metropolitan area.The Toys R Us credit card was a store credit card, specifically to be used at Toys R Us and Babies R Us stores. The card offered some excellent benefits for people who shop for toys frequently.

The Rewards of Toys R Us Credit Card

RewardsOpen an "R"Us Credit Card account online and choose 15% off or special financing (minimum purchase required) with your "R"Us Credit CardEarn 2 Points per $1 spent on eligible purchases at Toys"R"Us and Babies"R"Us; 1 point for every $4 spent outside &quToys R Us Credit Card Review

Full ReviewTwo offers, one application. As is the case with many retailers, there are two Toys R Us credit cards: the Toys R Us Mastercard and the Toys R Us Store Card, which can only be used to make Toys R Us purchases. You generally need good or excellent credit to get the Mastercard but only fairToys R Us Credit Card Payment

Toys R Us filed for Chapter 11 bankruptcy. Your credit card no longer works since all stores are closed, however, as with any credit card, you are responsible for all charges to that card, even if the store closes or goes bankrupt. You can pay your Toys R Us Credit Card bill in three ways. FirsZales Credit Card >>

The Zales Diamond Card, which is issued by Comenity Bank, is a standard store credit card good for purchases in Zales stores or online at Zales.com. If your goal is purchasing diamonds and other jewelry with special, in-house financing offers, getting this card may make sense. Just be aware of interest rate “gotchas” and fine print.

How to Get the Most Out of Zales Diamond Card

To get the most value out of this card, you'll need to be smart about how you use it. If you choose one of the deferred interest offers, be sure to pay off the entire balance before the promotional period is over. If not, you'll pay interest charges dating all the way back to your purchase dHow to Apply For Zales Diamond Card

If you don't have this credit card yet, you can submit an application online. But before doing so, make sure that you match the following criteria:18 years old or more/Being a U.S. citizen/Have a credit score of at least 660.If all that is in place, then you can try submitting an application onlZales Diamond Card Review

Details of Pros0% deferred APR deals: This card does offer 0% interest on six, 12, and 18 month promotional credit plans.1 These offers are common among jewelry store credit cards, but Zales has the advantage in that it doesn’t require a down payment like some competitors do. LowModell's MVP Credit Card >>

Modell's MVP Visa is issued by Comenity Bank. Modells Card offers cardholders exclusive discounts and offers. See trending Modells rates and reviews. Modell's MVP Visa is a store rewards credit card. If you're wondering whether Modell's MVP Visa is the right card for you, read on. This is everything you need to know to make a good choice.

Modell's MVP Credit Card

Modell's MVP Visa is a store rewards credit card issued by Comenity. If you're wondering whether Modell's MVP Visa is the right card for you, read on. This is everything you need to know to make a good choice.The Rewards of Modell's MVP Credit Card

RewardsEarn 1 MVP® point for every dollar spent at Modell’sEarn 1 MVP® point for every five dollars everywhere else Visa is acceptedGet a $20 award certificate for every 400 MVP® points earnedDiscount coupons in monthly billing statementsExclusive cardholder in-store eventsSpecial birthday coupModell's MVP Credit Card Payment

OnlineSign into your accountLocate the payment buttonChoose a payment method that best suits you, to make your Modell’s credit card bill paymentBy MailAlternatively, you can mail the payments, to the following address:Comenity Capital Bank, PO Box 183003/Columbus, OH 43218-3003DSW Credit Card >>

The DSW Visa® Credit Card is a great credit card for shoe lovers that makes it easy to save every time you buy new footwear. DSW customers to earn between 2X-3X points per dollar spent at Designer Shoe Warehouse (both in-store and online) and up to $50 in signup bonuses. If you're wondering whether DSW Visa Card is the right card for you, read on. This is everything you need to know to make a good choice.

DSW Credit Card Review

Full ReviewThe DSW Visa® Credit Card is a co-branded retail card issued by Comenity Bank and available to applicants with Fair credit (630) or higher. The benefits of being a DSW Visa cardholder include free return shipping, a $25 application bonus, and another $25 bonus for spending $500 outside oHow to Get the Most Out of DSW Credit Card

Shop at Designer Shoe Warehouse at at least every 2-3 monthsNormally find it too difficult to spend $500 to reach DSW VIP Elite statusHow to Apply For DSW Credit Card

OnlineVisit the DSW Visa Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.Herberger's Credit Card >>

Herbergers Credit Card is a card that comes with no charges on yearly fee, introductory APR. The card is issued by Comenity Bank.What some people like about this card is that its requirements are not high and it provides a lot of rewards that makes transactions so interesting. Not only that, but it can also be used at any Herbergers stores.

Herberger's Credit Card Payment

OnlineVisit Herberger's Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remHerberger's Credit Card

Herbergers Credit Card is a card that comes with no charges on yearly fee, introductory APR. The card is issued by Comenity Bank.What some people like about this card is that its requirements are not high and it provides a lot of rewards that makes transactions so interesting. Not only that, but it can also be used at any Herbergers stores.The Rewards of Herberger's Credit Card

Earn 1 reward point for every $1 spentEarn a $20 Rewards Card for every $200 you spendBirthday Celebration OfferExclusive Savings OffersSpend over $500 or $1,500 in a calendar year and get Elite or VIP status, respectivelyDouble the number of rewards cards you earn when you make purchases both in stTalbots Credit Card >>

Women’s clothing retailer Talbots, in partnership with Comenity Bank, offers a credit card that allows you to earn points toward future Talbots purchases. Talbots Credit Card is a store credit card issued by Comenity. If you're wondering whether Talbots Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.

The Rewards of Talbots Credit Card

RewardsEarn 1 point per $1 spent. Get a $25 reward at 500 points.15% Off Birthday Bonus and 100 points Anniversary Bonus gift.Bonus points events and Extra 5% off During Semi-Annual Red Hanger Clearance Sales.Reach Premier level on spending $1,000 in purchases per calendar year and earn 1.25 pointsTalbots Credit Card Review

Full ReviewWomen's clothing retailer Talbots, in partnership with Comenity Bank, offers a credit card that allows you to earn points toward future Talbots purchases. Our overview / review of the card is below:The first thing to understand is that the Talbots credit card can only be used at TalboHow to Apply For Talbots Credit Card

OnlineVisit the Talbots Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.BrylaneHome Credit Card >>

Fullbeauty is an umbrella holding company with multiple brands under its label. These include Woman Within, Roaman's, fullbeauty.com, Jessica London, ellos, swimsuitsforall, KingSize, and BrylaneHome. Brylane Home Credit Card is a store credit card issued by Comenity. If you're wondering whether Brylane Home Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.

BrylaneHome Credit Card

Comenity Bank is the issuer of the BrylaneHome Platinum Credit Card. This is actually a store card rather than a true credit card as it can only be used on FULLBEAUTY brands (BrylaneHome parent company).How to Get the Most Out of BrylaneHome Credit Card

Spend money on your BrylaneHome Credit CardEarn a Reward certificate that you can redeemReceive an exclusive offer for your ordersEnjoy shipping four times a yearThe Rewards of BrylaneHome Credit Card

RewardsGet $10 off your first purchase of $25 or more when you use your card. Plus $10 bonus reward on your first billing statement.Get 1 point for every $1 you spend on your BrylaneHome Credit Card at any of the fullbeauty brands.For every 200 points, earn a $10 Reward certificate that you can redeGoody's Credit Card >>

The Goody’s Credit Card, which you can use at any Stage store or on the retailer’s website, comes with generous rewards for frequent shoppers. But if you don’t hit those stores often, you’ll be better off getting a non-store rewards card that you can use to make purchases anywhere.Goody’s is one of the Stage family of stores, a chain of department stores stretching across the USA.

How to Get the Most Out of Goody's Credit Card

Recive Birthday GiftJoin Style Circle Community Membership.Goody's Credit Card Review

Full ReviewGoody's credit card appears to be a typical store branded credit card from this chain of stores. In 2009, after getting bust, Stage Stores purchased Goody's, and this company is nowadays incorporated in Stage Stores. That is the reason why this credit card is actually identical toGoody's Credit Card

Goody’s is one of the Stage family of stores, a chain of department stores stretching across the USA. You might also be familiar with this brand under the names Bealls, Peebles and Palais Royal. Goody’s in particular focuses on apparel, accessories, cosmetics, footwear and housewares.Haband Credit Card >>

Haband Credit Card is a store credit card issued by Comenity.This is a great option for people looking for a low-maintenance card. It gives you the benefits of a credit card, but you don't have to pay an annual fee for the privilege.You stand a chance of qualifying if your credit score is not below 650.

Haband Credit Card Review

Full ReviewThe 10% discount on the first order is considered average in credit card rewards. The annual birthday discounts and birthday gifts are not provided by every credit card. In addition, you can use the free shipping service four times a year, which can also provide a lot of convenience for yHow to Apply For Haband Credit Card

Haband Credit Card is a store credit card issued by Comenity.You can receive 10% off the first order paid with your credit card.Plus,You can enjoy the birthday gift of this card on your birthday month .It has no annual fee so you can use it easily.The Rewards of Haband Credit Card

RewardsReceive 10% off the first order paid with your credit card.A Special Birthday Offer each calendar year.Cardholder-Only Discounts- and the first arrives in your welcome package.Up to 4 Free Shipping Certificates per year.Exclusive Email Deals and Savings Opportunities.Special Savings each montTires Plus Credit Card >>

The Tires Plus Credit Card is perfect for those who put a lot of miles on their vehicles and need to regular service their car or truck. Tires Plus offers a no-interest-paid promotion in the case that a $299 minimum purchase is paid off in full within 6 months.

The Rewards of Tires Plus Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers. If you are a loyal customer of Tires Plus, then this card can provide you with new shopping methods and promptly notify you of special offers in the store.You’ll still be able to cHow to Apply For Tires Plus Credit Card

OnlineVisit the Tires Plus Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Read related terms and agreementsCheck the information is accurate and submit your appliTires Plus Credit Card Payment

OnlineVisit Tires Plus Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remaininApple Credit Card In US >>

Apple Card is a better kind of credit card. And with Apple Card Monthly Installments, you can pay for a new iPhone with interest-free payments.

I’ve used the Apple Card for a year–here’s what I think now

When the Apple Card launched last year, it revamped the way cash-back cards work with its unique Daily Cash program. Over the past year the card has changed a lot. Here’s how.More Merchants to Offer 3 Percent Daily Cash

Apple Card’s compelling rewards program, Daily Cash, gives back a percentage of every purchase as cash on customers’ Apple Cash card each dayShould You Get the Apple Card? What to Know Before You Bite

It's not a game-changer, but it does offer some intriguing features. Here's how to know if it's right for you.Brooks Brothers Credit Card >>

If you’re in need of a classic outfit for an interview, wedding or other formal occasion, you may turn to the timeless American brand Brooks Brothers, known for its quality pieces and exceptional service. Frequent customers may have been asked to apply for The Brooks Card® or the Brooks Brothers Platinum Mastercard at checkout to earn rewards on their purchases. While these cards can help you earn points toward Brooks Brothers rewards certificates.

Brooks Brothers Credit Card Review

Flat rate.A flat-rate cashback rewards credit card is a good alternative to The Brooks Card® and the Brooks Brothers Platinum Mastercard since you can earn a consistent amount of cash back on all your spending — both inside and outside of Brooks Brothers. The Citi® Double Cash Card – 18 monthHow to Get Most Out of Brooks Brothers Credit Card

The Brooks Brothers Mastercard comes with a decent sign-up bonus of 15% off Brooks Brothers purchases for the first 30 days. Brooks Brothers is a premium brand that charges premium prices, so earning 15% off purchases is a nice perk that can offer real savings to new account holders. Cardholders alsThe Rewards of Brooks Brothers Credit Card

Receive 15% off your Brooks Brothers purchases for the first 30 days upon receipt of your Brooks Brothers Welcome Mailing.One time $50 off select Brooks Brothers in-store purchase of $200 or more.Receive a $20 rewards card when you make your first purchase outside of Brooks Brothers within 60 days oJ.Jill Credit Card >>

J Jill is a clothing retailer for women, offering a range of fashionable clothing and the latest trends, plus shoes, accessories and outsize clothing. The company is known for attractive deals and savings events, though with the J Jill credit card savings open up to you all year round.

How to Apply For J.Jill Credit Card

OnlineVisit the J.Jill Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Read related terms and agreements.Check the information is accurate and submit your applicatThe Rewards of J.Jill Credit Card

15% off your first J.Jill credit card purchase.Take 5% off every card purchase.Additional 20% off one day you choose during your birthday month.Exclusive cardholder events, special offers & private sales.Complimentary gift packaging on all catalog & online orders.How to Get Most Out of J.Jill Credit Card

This card can only benefit a hardcore J.Jill shopper. Once you receive your card, you’ll earn 10 percent off your first J.Jill credit-card purchase. You’ll then earn a discount of 5 percent on all other purchases that you make with your J.Jill card. You’ll receive an additional 5 percent off oAmazon Credit Card >>

The Amazon Credit Card is the best credit card for Amazon Prime members, as well as an excellent way to save for anyone with a 700+ credit score who likes to shop online. The Amazon Visa Card has a $0 annual fee and rewards users with 3% or 5% back on Amazon purchases (Prime members get the higher rate). Those earning rates are nearly 3- and 5-times the market average for a rewards card, respectively. You can learn more about this lucrative everyday rewards card below:

Maximize your cash back on Amazon Credit Card

Earn 5% back on all Amazon purchasesDid you know it’s possible to get 5% back on every single thing you buy from Amazon? It’s extremely easy if you have the Ink Business Cash℠ Credit Card.The secret is to purchase Amazon gift cards at either Office Depot, Staples or Office Max. There is a ~$6The Rewards of Amazon Credit Card

RewardsA $50 Amazon.com Gift Card ($70 for Prime members) will instantly be loaded into your Amazon.com account upon the approval of your credit card application.Earn 3 points for every $1 spent on Amazon.com and Whole Foods Market, 2 points for every eligible $1 spent at gas stations, restaurants aAmazon credit cards: Which card fits your shopping style?

Amazon.com Store CardAnnual fee:NoneSign-up bonus:$60 Amazon.com gift cardRewards:Zero-interest financing for various amounts and types of purchasesVariable APR for purchases and balance transfers:27.49%. Not eligible for balance transfers.Other benefits:NoneAmazon Prime Store CardAnnual fee :NBjs Credit Card >>

BJ’s offers two no-annual-fee credit cards: The BJ’s Perks Elite and the BJ’s Perks Plus, both of which provide ample rewards for frequent customers of the wholesale club.The BJ’s credit card may not be as good as other cash back credit cards, but it’s still worth consideration. Depending on which card you get, you can get between 3% and 5% back on BJ’s purchases, and 2% back on gas and restaurant spending. The BJ's credit cards are a great deal as long as you don't mind getting in-store vouchers as rewards.

BJ's Perks Plus Credit Card

Those who frequently shop at BJ's can find decent savings with their store credit card. The credit card also features a decent 2% savings on gas and restaurant purchases – you also receive $0.10 off each gallon of gas purchased at BJ’s.How to apply for My BJ's Perks Mastercard

Visit the My BJ's Perks Mastercard website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.If you're denied click hereHow To Pay Your BJ’s Wholesale Credit Card

If you are the holder of a BJ’s MasterCard issued by Comenity Capital Bank, you have a number of options to pay your monthly card bill, including paying:Online: Log in to your account at https://c.comenity.net/bjs/ and make your payment.By Mail: Send your payment to the following address: BJ’s MEddie Bauer Credit Card >>

Eddie Bauer LLC is a limited liability company that operates the Eddie Bauer clothing store chain. The company has more than 300 stores in the United States. Through their partnership with Comenity bank, the company offers financing to shoppers using the Eddie Bauer credit card. If you frequently shop at Eddie Bauer, you can earn rewards with an Eddie Bauer credit card from Comenity Bank. By joining adventure rewards, you can earn additional 2% rewards on every purchase made using the credit card. Besides, you will also enjoy cardholder exclusive promotions which include special sales and pre-shopping events.

The Rewards of Eddie Bauer Credit Card